This post may contain affiliate links, which means if you make a purchase through these links, I may receive a small commission at no extra cost to you. As an Amazon Associate I earn from qualifying purchases. Please read my disclosure for more info.

How to Use the 50/30/20 Budgeting Method for Budgeting Success

The 50/30/20 budgeting method is an easy budgeting method for people who do not like to assign every penny they make to one very specific category. This way, you maintain a lot of flexibility.

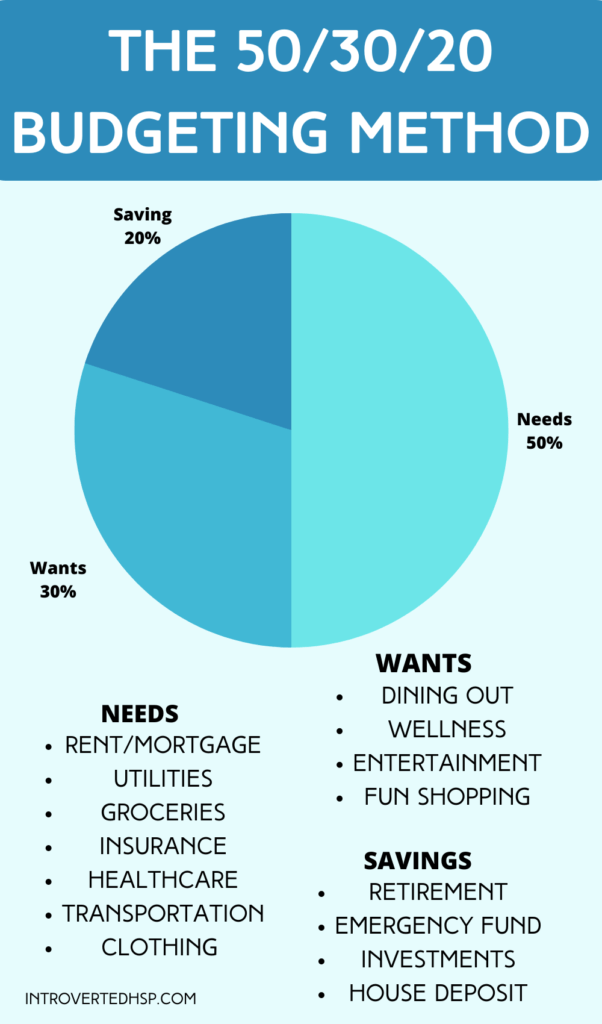

In this budgeting method, you divide your after-tax income into 3 categories each containing 50%, 30%, and 20% of your after-tax income. So your income goes to your needs, wants, and savings.

- 50% for your needs

- 30% for your wants

- 20% for your savings or goals

Before you can do this, you have to know how much your after-tax income is. You calculate this by adding up all your different income streams. If you have a partner, also add their income streams. Income streams may be a paycheck from your day job, dividends, interest, side hustle income, etc.

When you know your total after-tax income, then you can calculate the percentages.

Here’s an example of a calculation.

After-tax income of 3000 dollars/euros.

- 3000 x 50% = 3000 x 0,50 = 1500 dollars/euros

- 3000 x 30% = 3000 x 0,30= 900 dollars/euros

- 3000 x 20% = 3000 x 0,20= 600 dollars/euros

When you have an after-tax income of 3000, you will have 1500 for your needs, 900 for your wants, and 600 for your savings or financial goals.

But what do the 3 categories represent exactly?

What are your needs?

Your needs are the things you absolutely need, they are necessities to live and not die.

Sometimes it is hard to know the difference between your needs and your wants so let me give you some examples.

Examples of needs:

- Rent/Mortgage

- Utilities

- Groceries

- Insurance

- Healthcare

- Transportation

- Basic clothing

The things you literally can’t live without.

You may feel like you need a pretty dress to be able to go to that fancy party or you need a coffee from Starbucks every time you pass a Starbucks, but those things fit better on your want list.

You need food in order to live but you don’t have to be dining out every weekend, also another thing for your want list.

What are your wants?

This is the most fun part of your budget. You get to spend 30% of your after-tax income on things you like to spend your money on.

Examples of wants:

- Wellness

- Dining out

- Activities

- Shopping (clothes, jewelry)

- Entertainment (Netflix, concerts, cinema)

- Hobbies

The list is endless!

With this budgeting method, it is important to not spend more than 30% on your wants. If you go over your budget every month, maybe you can cut some expenses to make it fit the 30%.

Some people who are hardcore into saving money can find it hard to spend money, especially on themselves, which can lead to a sort of fatigue from their frugal lifestyle. To avoid this fatigue, it can help to allow yourself a part of your income for fun spending. Guilt-free!

You are still working towards your financial goals so you don’t have to feel bad about letting yourself enjoy life a little more.

You might also like: 23 Self-Care Activities Without Spending a Lot of Money

What are you saving for?

What are your financial goals? Do you want to be sure you have enough money when you retire, do you want to retire early or do you finally want to become debt-free?

Make a list of your goals, big ones as well as little ones.

To make sure you have a financially secure future, you should save enough money so that you are safe when you stop earning money for a while or forever (retirement).

Examples of savings/financial goals:

- Emergency fund

- Retirement

- Buying a house (deposit)

- Paying off debt

- Paying off student loans

- Investing in the stock market

The great thing about this budgeting method is that you always prioritize your financial goals by putting away 20% for them. However, you do need specific financial goals to not spend the money on other things.

You can adjust this method to your own financial goals in life. Some people change the percentages to percentages that fit their lives better.

Variations in this budgeting method

There are a lot of variations on the 50/30/20 budgeting method.

For example, the 60/30/10 budgeting method is more for people who can save more from their income.

- 60% saving/investing

- 30% needs

- 10% wants

Another example would be the 70/20/10 budgeting method, this budgeting method divides your after-tax income into 3 categories, but into different categories than the ones we explained before.

- 70% for all of your spending, so your needs and your wants are combined in this budgeting method

- 20% saving and/or investing

- 10% for paying off debt or for donations

Is the 50/30/20 budgeting method a good fit for you?

When you get the same amount of money on your paycheck every month, this method can be good for you! This budgeting method is a good fit for people who like to have a budget without having a ton of different ‘buckets’ for every spending category. It’s a very flexible budgeting method.

The 50/30/20 budgeting method is a little bit harder for people who don’t earn the same amount every month, especially for those where it heavily fluctuates between good and bad income months.

My recommendation would be to make a budget based on your lowest income months so you will always be able to pay for your basic needs.

You could also calculate an average monthly income by adding up every income for the past 12 months and dividing it by 12. Make sure you set aside some money on the higher income months to add to your lower income months to balance your budget.

Another way to make it work when you have an income that fluctuates is to recalculate the total amount for each category for each new month. Make sure that you have enough money for your basic needs though!

Of course, every budgeting method has its pros and cons, try a few and see what budgeting method works best for you! It has a lot to do with personal preference.

You might also like: Budgeting Tips For Beginners: How to Start Budgeting or The Cash Envelope System – Easy Explanation to Help You Stop Overspending.