Thank God that an alternative to the regular cash envelope system has been invented, the digital envelope system!

Modern society is becoming more and more cashless every day. Most stores prefer payments by card since COVID-19 has happened. Because using the card is more hygienic, there is less hassle with giving back the correct amount of change and you don’t have to stop at an ATM to get your money out. So easy!

However, if you like cash and like to carry it with you, check out this blog post about the cash envelope budget system I wrote before.

With this method, you can keep a tight budget that is flexible as well. It is also recommended to work with sinking funds for this budgeting method.

Let’s Dive in!

This post may contain affiliate links, which means if you make a purchase through these links, I may receive a small commission at no extra cost to you. As an Amazon Associate I earn from qualifying purchases. Please read my disclosure for more info.

What is the Digital Envelope System

The digital envelope system is a way to control your budget. It looks very similar to the cash envelope budget system but you don’t have to have cash to use it.

For this generation, it’s a great alternative to raise your spending awareness and stick to your budget. Because we live in a digital age, where cash has become more and more obsolete, paying for most things by card is the norm.

I think everyone who wants to take control of their finances needs to know what their expenses are on average and how to budget for them. The digital envelope system is a way to implement your budget in practice. You will always know how much money you have left to spend each week or month if you use this method. Very handy!

How to use the Digital Envelope System

Before using the digital envelope system, you should create a budget for yourself. Let’s talk about budgeting first.

Creating a budget

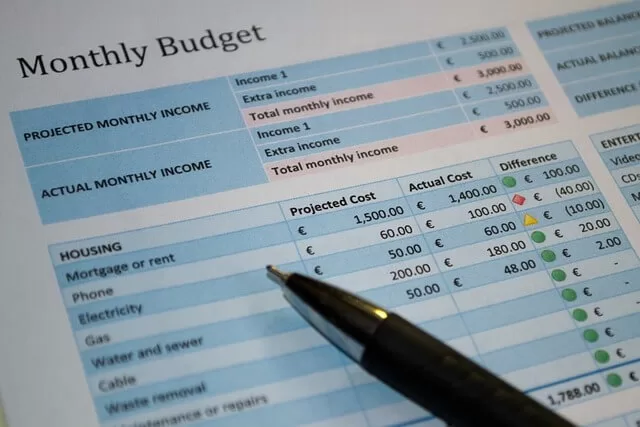

Creating a budget starts with knowing your income and having a good idea of your monthly expenses.

Figure out the total income you have available every month. This is the net income so the money you can keep after taxes! You could create a budget for yourself or your family. If you do this for your family, include every penny that comes in every month. This includes the salary of your partner, child support, etc.

After you have figured out how much is coming in each month, list all the fixed and variable expenses you make. When you have a good estimate of where you spend your money, you can create a budget for everything. It’s difficult to create a budget for every single expense so you have to create categories for your different expenses.

With your fixed expenses, this is easy, as you know exactly how much money you need for them every single month. But for the variable expenses, you should give it your best estimate. Let me give you a few examples of spending categories: food, housing, utilities, transportation, etc. You could also create a budget for sinking funds. Learn more about sinking funds in one of my previous blog posts.

Having a set amount of money you can spend on the different spending categories can help you stick to your budget. This way, you are less likely to go over budget and get into debt. If you overspend in one category, try to compensate for it in another so that at the end of the month, you will still have some money to spare.

Okay so now you know a little about how to create a budget and stick to a budget, it’s time to start implementing the digital envelope system.

The Digital Envelope System

The digital envelope system can have envelopes like the cash envelope method but the difference is in the stuffing of the envelopes. There isn’t really any envelope stuffing involved, but there are cards where you track all your spending and calculate the amount of money left every time you spend something.

You can make those tracking cards by yourself or premade budget sheets to keep with you when you go shopping. Here are some premade sheets that are also envelopes if you would like to use the cash method you can but you don’t have to. You can also buy a budget binder that holds your cards as well as your budget sheets.

Because you keep the cards with your spending in your wallet or tracker, you will be more aware of how much money is left to spend on each spending category. This can be less effective than seeing and spending the actual cash money, but it will bring some awareness to your spending habits which is great!

On these tracking cards, you will write down the total amount of money available for that category per month. In the expense columns, you can write every expense down and calculate the balance in the balance columns by deducting the cost of the expense from the total amount of money you budgeted for that category. This way, you will always know how much money you have left to spend.

If you have money to spare at the end of the month, you can put this into your savings account or transfer it to your next month’s budget or another category.

When you don’t want to have cash on you all the time or if you are afraid of having too much cash with you, this digital envelope system might be a great fit for you.

You can try to live totally cash-free but sometimes it may be good to have a little cash on hand. You can keep one envelope with a little cash for when you have to tip a waiter or put something in a jar at work to save for a coworker or a fun event.

Conclusion

The digital envelope system is a great way to gain more control over your finances. When you want to become financially independent, having a budget and sticking to it might be the first step in your journey.

Avoid getting into debt by creating a budget every single month and your future self will be so grateful!

Try this budgeting method to see improvement in your finances and have a more financially secure life.

You got this!